1. What does the company do?

About the company-

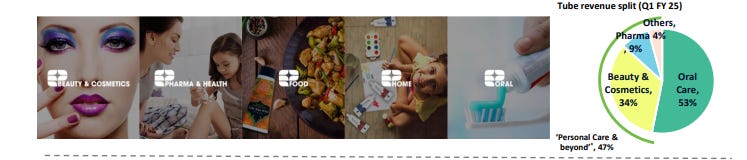

Established in the year 1982, EPL Limited is world largest laminated tube manufacturer (Collapsible tubes), providing packaging solutions to the fast moving consuming sector. They cater to diverse categories that includes brands in Oral care, BPC, Pharma & health, food and home offering customized solutions. , EPL manufactures one in every three tubes used in the oral care category across the globe. Company deals in categories such as laminates, laminated tubes, extruded tubes, caps, closures, and dispensing systems.

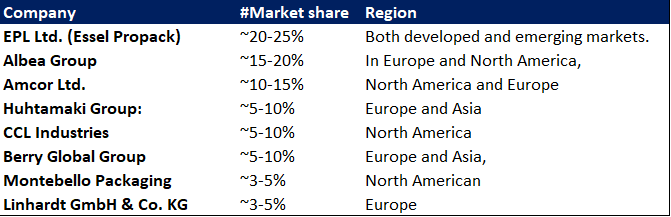

EPL Limited holds a strong position in the global laminated tubes market, capturing approximately 20% of the total market, which produces ~42 billion tubes annually. In the oral care segment, EPL dominates with a significant 35% market share, reflecting its leadership in this category. However, its presence is moderate in other sectors, with ~10% market share in beauty, cosmetics, and pharmaceutical segments, and ~8% in food, home, and industrial sectors.

2. Who are its promoters? What is their background?

3. What do they manufacture?

-They offer customized packaging solutions in laminates, laminated tubes, extruded tubes, caps & closures and dispensing systems to the fast moving consumer world.

4. How many plants /units they have and where it is located?

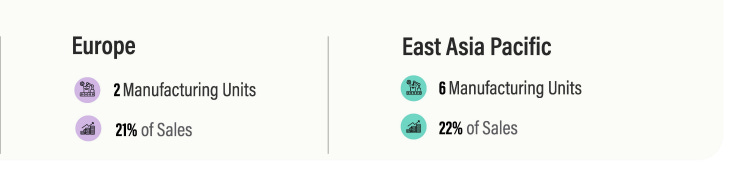

EPL has 21 manufacturing plants in 11 countries across the world; the company commissioned a greenfield manufacturing unit in Brazil in FY23, with operations already getting ramped up at that unit. China, Colombia, Egypt, Germany, India, Mexico, Philippines, Poland, and the USA. With an annual production of over 8 billion tubes, EPL manufactures one in every three tubes used in the oral care category across the globe.

5.Are they running the plant at full capacity?

-Company has in total 21 art of the manufacturing hubs . On an average according t5o management guidance company is running at 80% of their capacity.

6. What kind of raw material is required ?

Polymer Prices are usually correlated with crude oil prices and factors like supply issue and geopolitical tensions also affect this

Aluminum prices may get affected mainly by the increase in energy cost.

7. Who are the companies clients and end users?

8 .Who are their competitors?

9. Who are the major shareholders of the Company?

As of June 2024, the Blackstone Group L.P., through Epsilon Bidco Pte. Ltd. owned a 51.5% stake in EPL. As the sponsor, Blackstone also provides robust financial backing to EPL, thereby improving its financials.

10. Do they plan to do any type of innovation in their product or technological advancement?

To boost the lamination capacity in China , they acquired blown film line machinery.

Introduced New cap Tools In the B&C segment.

To cater the high demand in the Oral and Beauty segments, company has expanded their tubing capacities in Brazil, Poland, and India. Brazil’s capacity has increased to 330 mn units per annum, India’s to 120 mn units per annum, and Poland’s to 120 million units per annum

Currently they have start manufacturing NEOSIM tubes which is one of their innovation.

They were already manufacturing PLATINA range which are fully recyclable, eco-friendly laminated tubes. They are made from high-density polyethylene (HDPE), allowing for easy recycling and reduced environmental impact. This range includes innovative features like an integrated barrier liner for durability, making it suitable for products in oral care, food, and toiletries.

11. Do they plan to expand to diff countries?

Their revenues currently come from various geographies. Mainly AMESA (Africa, Middle East, South Asia), East Asia Pacific, Europe, and the Americas.

-The companies expansion efforts in Brazil are doing well . They have started supplying to new customers in Q1 FY '25, including two multinational clients and a local partner, alongside our anchor customer. The customer base expansion within just one year of plant commercialization reflects a huge potential in this market for EPL.

12. What is the revenue Mix ? Which product sells the most?

13.Do EPL operate under heavy regulatory environment?

Yes. Yes, EPL Ltd. operates in a heavily regulated environment due to the nature of its products and the markets it serves.

Environmental Regulations : Since EPL produces different laminated tubes , it may face strict issues regarding the plastic usage recycling, and waste management. Different countries have various laws regarding the usage of plastic and its waste management .

Health and safety regards: For pharma products , cosmetics, and food packaging, they have meet certain safety standards, ensuring its materials are safe for direct contact with consumables. They have to be supervised with guidelines from organizations such as the U.S. FDA and the European Food Safety Authority.

Financial Highlights:

Q1FY25 Updates.

Results:-

Consolidated revenue reported double digit growth of 10.7% .In the AMESA region, revenues grew by 9.5%, with India standalone growing at 8.6%. The EAP region delivered a strong growth of 13.9%, while Europe grew by 9%. In the Americas, we achieved a high double-digit growth of 18.9%.

EBITDA posted a growth of 19% with margin improvement of 160 BPS to 19.1%

Company has saw a high demand towards there oral care range driven by natural growth and increased consumer spending .

Reported PAT grew by 18.7% while adjusted PAT grew by 35.5% (Excluding One off item)

ROCE stood at 15.9%, an increase of 1.9 percentage points, excluding one-offs.

Sustainable Tubes now contributes 29% of their total volume.

Brazil shows results of their expansion efforts with 2 multinational clients and local players have been added as a new customers.

Margins have increased in Europe by 230 BPS compare to the past year. Similarly Americans Margins have also improved from single-digits to high-teens.

FY24 Highlights:-

Results:

Revenue grew by 6%, EBITDA rose by 19.2% and EBITDA Margin expanded by 202 BPS and adjusted PAT grew by 28%.

Conclusion:

The global laminated tube market is projected to grow by 6.3% annually from 2023 to 2033, and it's currently valued at $1.12 billion. EPL, a major player in this industry, holds around 20% of the global market share. In the oral care category, EPL has an impressive 35% share, demonstrating strong leadership in that sector. However, its market share in other categories is more moderate: around 10% in beauty, cosmetics, and pharmaceuticals, and about 8% in food, home, and industrial sectors. Geographically, the company's revenue is well-diversified across four regions: AMESA (which represents approximately 33% of revenue), EAP (~22%), Americas (24%), and Europe (21%).

EPL’s revenue has shown consistent growth, with a 5-year CAGR of 7.67% and a 3-year CAGR of 8.2%. EBITDA has also grown at a similar rate to revenue over these periods. However, net profit (PAT) growth has been modest, with a 5-year CAGR of only 1.23%, indicating that the company is struggling to translate its revenue growth into net profit. This suggests a lack of operating leverage at the net profit level. While EBITDA margins have improved by 300 basis points this year compared to the previous two years, PAT margins have been declining, from around 7% to a range of 5-6%, which has led to stagnant EPS over the years. Consequently, return ratios have also been under pressure due to stagnant or declining net profit margins.

On the positive side, EPL's debt-to-equity ratio has been decreasing, reflecting a shift towards funding with equity rather than debt, which is a good sign for solvency. The management is optimistic, projecting double-digit revenue growth and aiming for EBITDA margins above 20%. The company’s expansion in Brazil is progressing well, with new clients coming on board, particularly in the beauty sector, which is attracting attention in both the EAP and European regions, potentially opening up new growth opportunities.

EPL benefits from high barriers to entry in the industry, which serve as a competitive moat. However, there are risks: EPL relies on polymer granules, especially linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which exposes it to fluctuations in crude oil prices. Additionally, currency fluctuations add further risk. From a valuation perspective, the company's share price has been driven primarily by price rather than EPS growth. However, if EPL can achieve meaningful EPS growth, it will likely justify its current valuation and signal further potential for growth in the future.

NOTE

Investing involves risks, including possible loss of principal. Please do your own research or consult a financial advisor before making investment decisions.

Thanking You

Mohit Jain

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas." — Paul Samuelson

Great post 👏👏👏 very informative 👍